Investment App & Dashboard

Summary

I led the UX design for Axos Bank's "Managed Portfolios," a robo-advising investment product for web and mobile. This project highlights the mobile designs for a key feature that enables users to automatically change their portfolio over time to meet their investment goal.

This product is now released. For more info on Axos Bank and this product, check out Managed Portfolios on the Axos Bank website.

Case Study

Role: Lead UX designer for a new iOS and web-app product. Directed end-to-end experience from concept to release.

Team: I worked in an agile environment, collaborating weekly with developers, a PM, and a user researcher. I also incorporated feedback cross-functional partners and other designers.

Project Objectives

The goal of this project was to design a “Managed Portfolios” product for Axos Bank’s new robo-advising investment account and innovate useful features to help customers easily manage and understand their investments.

Skills & Tools

User Research

User Flows

Wireframes, Mockups, Prototypes

Figma

User Research

I collaborated with a user researcher to conduct qualitative interviews to assess user needs. We aimed to determine how users add additional funds to their account, how well users understand their portfolio, and how they fund and adjust their account to meet their goals over time.

Method

Procedure: remote moderated qualitative interviews & survey

Participants: 7 individuals were recruited to participate in this study. There were 3 male and 4 female participants between the ages of 31 to 40 earning between $50K - $125K a year. They received compensation for taking part in the study.

Top Findings

Lack of transparency behind how portfolio strategy is created and how information is used results in lack of trust with the product to manage customer’s money.

Customers need to feel that their goals and financial standing are adequately taken into consideration by the product

Customers want a clear breakdown of their portfolio, and ability to project it out to the future, and a sense of control over meeting their goal

80% of customers prefer using a mobile investment platform

Quote

Supporting finding #1 & #3:

”[It] didn’t really explain why - why is it good to have this [portfolio]? There’s no place to learn more, no way to expand details. It’s giving a strategy but I don’t know why”

-User Research Participant

Supporting finding #3

“Saving up for a house is a financial goal right now. Won’t tap into money so that’s why I have aggressive and I’ll change it later to steady when it gets closer to accessing the money.”

--User Research Participant

Key Takeaways

Show breakdown of assets & explain algorithm behind portfolio strategy in a way that makes users feel understood and valued

Allow user to see different portfolio options by easily adjusting investment preferences to give users a greater sense of control and confidence in meeting their investment goals

Problem Statement

Users lack trust in our robo-advising investment platform due to lack of transparency of portfolio assets and limited control over how their portfolio will meet their financial goals.

The Solution

One solution to the problem included a feature I designed called a glidepath portfolio that allows users to control and visualize how their porfolio assets change (or “glides”) over time by setting an end target to meet their investment goal.

Final Design (Key Screens)

Final Flow

After many iterations, conversations with the PM and engineers, and feedback, this was my final task flow for editing a glidepath portfolio.

Major Design Decisions

Final Prototype of Key Feature

Based on the 2 key takeaways from our user research, I collaborated with a PM to brainstorm features and to design a key feature of this investment product: a glidepath portfolio.

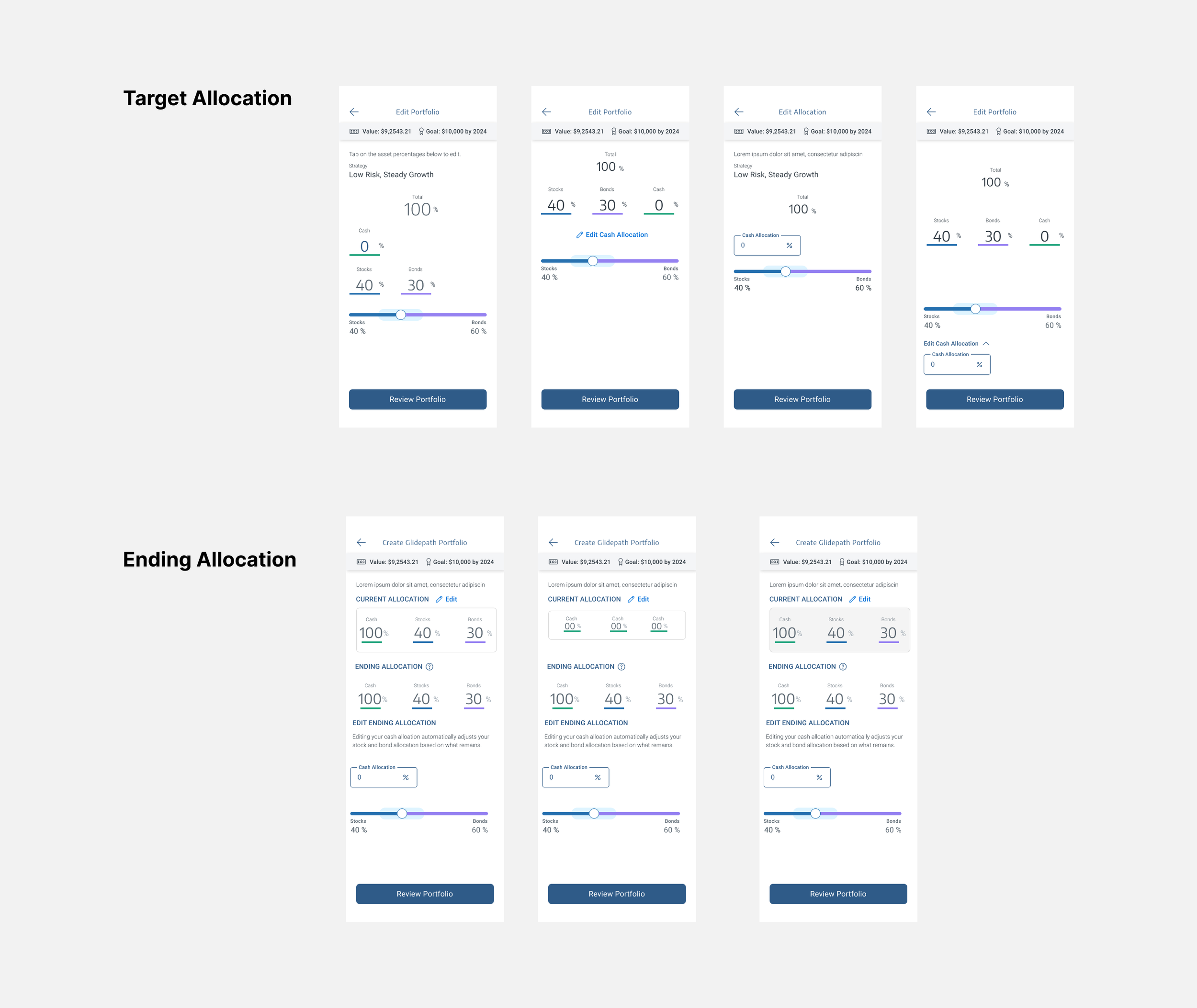

A key design decision is to give users control over the allocation of their portfolio assets (stocks, bonds, and cash), while trusting the platform to manage specific assets within those categories and to clearly display them.

This prototype demonstrates the major task flow for this feature, the ability to add/edit the portfolio’s end target (the allocations of stocks, bonds, and cash users will have at the end of their investment goal) and view how their investments will change over time.

Additional Details

Design Iterations

These are some iterations I considered when trying to determine how to enable users to break up their assets into stocks, bonds, and cash.

These are some other graph concepts I considered to visualize how a portfolio will change over time.

Other key features I designed for this investment product

Ability to easily adjust stocks, bonds, and cash allocation and change the allocation over time (shown in video)

Interactive graph of past and current performance

Progress bar towards goal

Tools to project out additional funding and portfolio into the future

Both high-level and detailed view of portfolio assets

Major User Cases

Register for an account

Fund the account

Add additional funds to the account

Edit portfolio (stocks, bonds, cash)

Edit current target allocation

Edit end target allocation (glidepath portfolio only)

View how allocations automatically change over time

Set an investment goal

View progress of goal overtime

Figma Mockups

For more details or questions, feel free to contact me at yukaokina@gmail.com or reach out on LinkedIn for any pressing questions 💁♀️